LFCU has been a local community Credit Union serving Lebanon county since 1969. LFCU takes pride in donating to over 100 different organizations in Lebanon County each year. Scholarship opportunities are also provided to all the local area high schools. Adult and youth financial literacy programs are offered. Seminars are scheduled throughout the year to educate members about our financial services. LFCU employees and their families volunteer countless hours in the community each year. Lastly, LFCU offers all the financial products and services that the “big banks” offer, but with a personal touch!

Banking

If you live, work, worship or attend school in or have a business or other legal entity in Lebanon County, you are eligible to join the credit union. You are also eligible to join if you have an immediate family member who lives, works, worships or attends school in Lebanon County. Once you become a member, individuals in your family also become eligible to join. If you are eligible, complete the online Membership Application and a Member Service Specialist will contact you.

Start the process online to become a member by clicking the link below.

If you would like to become a member in person, please visit one of our four convenient branch locations:

Click to learn more:

Difference Between Credit Unions & Banks

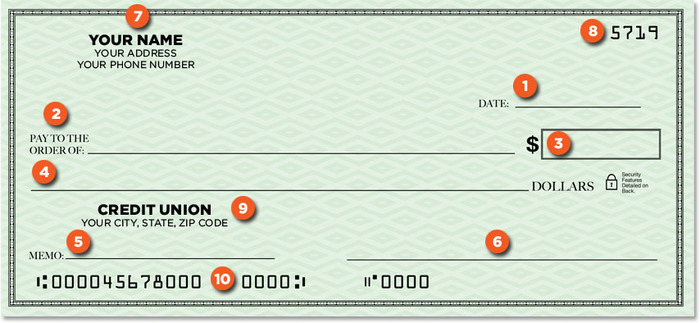

- The date.

- The Pay to the Order of line.

This is where you write the name of the person or company to whom you will give the check. After writing the name, you can draw a line to the end. This prevents anyone from adding an additional name on your check. - The dollar amount of the check in numbers.

Such as $19.75. - The dollar amount of the check in words.

Such as Nineteen and 75/100. After writing out the amount of the check, draw a line to the end. This prevents anyone from adding an additional amount after what you have written. - The memo section.

This area is optional. You can use this area to remind yourself why you wrote the check or to record the account number of the bill you are paying. - The signature line. Did you know that the line you sign on is actually micro-sized text that forms a line? This is one of many security features on a check.

Source: mycreditunion.gov

How to Balance Your Checkbook

- Update your balance in your checkbook register by keeping track of each withdrawal and deposit as they occur.

- When you receive your monthly statement from your credit union, balance, or reconcile, the statement to your checkbook register. To reconcile the statements, match each transaction in the statement to the transactions in your register and place a mark next to the transaction in your register for each transaction that matches the statement. If you have a record of a transaction that does not appear on the statement, the transaction may still be pending or may not have been presented to the credit union.

- The balances as of the end of the month should match. If the balances do not match, check your register to see whether one of your withdrawals or deposits has not been processed, the credit union has a record of a transaction that you do not have recorded in your register, or the amount of one of the transactions differs.

- To match your current balance to the balance from the statement, add back to your current balance any withdrawals made after the date of the statement and subtract the amount of any deposits made after the date of the statement. This should match the balance from the statement.

- If the balances still do not match, check your register and receipts against the record from the credit union to determine whether an error has occurred. Also check for any arithmetic errors (e.g., adding rather than subtracting) in your register. If you believe an error has occurred, contact your credit union

Click to learn more:

mycreditunion.gov

Source: mycreditunion.gov

Budgeting

Money might be tight when you’re in college, but it’s not impossible to find ways to save. Here are some simple ideas.

Budget

It’s smart to create a spending plan so you know where and how you’re spending your money. If you don’t know where your money is going, it’s impossible to know what to cut back on. Too many dinners out with friends and an unexpected book you have to buy for class may find you short on cash at the end of the month.

Food

Prepping meals at home can save you a lot of money. One meal out can cost as much as one cooked meal and the leftovers for two more meals. Never go grocery shopping when you’re hungry. Stock up on sale items you can easily store or freeze to save time and money.

Textbooks

Before you go out and buy the newest copy of each book for your classes, shop around. Look for used versions of textbooks or rent them if possible. Sometimes you even can find textbooks at the library. If you have to buy a textbook at full price, take good care of it so you can sell it back at the end of the semester.

Entertainment

Having fun inexpensively while in college should never be a problem. Instead of spending money on entertainment, check out the free events your campus has to offer—concerts, movies, speakers, sporting events. Stay in shape with the free fitness classes or intramural sports offered at your school’s recreational center. Lastly, ditch your cable—watch shows and movies online or borrow them from the library.

- Create a Budget

List all of your essential expenses that stay the same each month ( like rent or a bus pass) and all that change weekly ( like groceries). Set aside money for the expenses. The left over money can be used for non essentials, like entertainment, etc. Avoid overspending. If an unexpected expense comes up, decide which non essential items to cut to pay for the expense. - Apply for loans you know you can repay

A good rule of thumb is don’t borrow more than you can expect to earn your first year out of college. - Apply for scholarships

You’ll need to write a few dozen essays, but the money you get will be well worth your time and effort. - Buy used textbooks

If they’re the same edition, they have the same information as the new ones,. Electronic versions are often available and can be rented through your campus bookstore or online at sites like Chegg and Amazon. Also, see if your library has a copy. - Use Cash

Paying with cash instead of using a debit or credit card helps you control miscellaneous purchases,. Cash creates a sense of loss that cards do not. - Join a credit union

Credit unions have lower loan rats, free checking accounts, and a nationwide network of surcharge-free ATMs. They also provide financial education to help you manage your money.

sources:

U.S News (Money)

No one likes throwing away food, especially if you’re trying to save money. But what do you do with those fresh string beans you got on sale that may not get eaten before they go bad? Freeze them. Follow these handy tips and you’ll be able you to enjoy your favorite foods for months.

Many people wonder how they can build an emergency fund when they’re trying to pay off my debts. It isn’t as hard as you might think. The strategy is to start small, change a few habits, and change your mindset.

If you’re starting from scratch with your emergency fund, begin by saving one month’s worth of living expenses while paying the minimum on your credit cards. When you have that first month of emergency funds started, turn your focus to your credit card debt and pay more than the monthly minimum. Once the credit card debt is paid off, go back to building your emergency fund. If your credit card debt is very high and can’t be paid in full within a couple of months, then alternate the extra payment every other month: The first month, add to your emergency fund and pay the minimum on your credit cards. The next month, pay more on your credit cards and skip the deposit to your emergency fund, etc.

Here are five ways to boost your emergency fund and change savings habits for life:

Treat savings as a bill. Figure out what you can afford to save each month and stash away $75, $50, $25, or even $10 a month. No matter the amount, it adds up and can become habit-forming. As your financial situation improves, increase the amount.

Live one raise behind. When you get a raise, don’t begin spending more. Instead, apply the extra amount to your emergency fund.

Automate it. Set up an automatic transfer to your emergency funds account. When the credit union receives your direct-deposited pay check, you can have a portion of it put directly into your savings or emergency account. Out of sight, out of mind, but you know it’s there if you really need it.

Give savings a garage-sale boost. Go from room to room in your home and purge stuff you no longer want and need. Then schedule a garage sale. Both your house and your savings will look better.

Think of it as a life jacket. If you can’t find that initial spark to get started, ask yourself how you’d pay your bills if you lost your job tomorrow. Having an emergency fund will help you keep “your head above water.”

Remember: The professionals at LFCU are ready to help with all your savings needs. Call us at 717.272.2210 to set up short-term and long-term savings vehicles that fit your needs.

College years are the time when many people establish financial habits that will carry them for the rest of their lives.

Pay attention to these items to get off on the right financial foot:

- Spending plan: Know how much money you have available for college expenses. Create a workable monthly spending plan that balances income, loans, and gifts with anticipated expenses.

- Records: Use an app to track expenses or monitor expenses online. Tracking expenses will help you see where your money is going and adjust your spending as needed. Also, remember to review your financial statements every month.

- Credit cards: Commit to paying credit card bills in full and on time each month. Using credit wisely teaches you how to live within your means while creating a positive credit record that could help when buying a car, renting an apartment, obtaining insurance, and even landing a job.

- Organization: Keep all financial records, bills, and account statements in one location. This will help you pay bills on time, avoid late fees, and keep an unblemished credit score.

- Personal information: Learn about the different forms of identity theft, the kinds of personal information you need to protect, and how to protect information—even, and especially, from friends and roommates. Learn the pitfalls of careless use of social media.

Apps make personal finance easy

There are many apps to help you manage your money.

Or, there are others that might help as well:

Student Lending

How to Fill Out a FAFSA Correctly

Each October, the Free Application for Federal Student Aid or FAFSA is made available for the next school year. This is the form that families fill out to apply for federal grants, loans, and work-study funds for college students. It is administered by the U.S. Department of Education, which provides more than $150 billion in student aid each year.

Your eligibility for federal grants (which don’t have to be repaid) and federal loans (which do) will generally be based on your financial need, and this is determined by the information you supply on your FAFSA. You can apply online or print out a PDF from the website and mail it in.

Filling out this form may seem like a daunting task, but changes to the process have made it easier than ever before. Before you start, have the following information ready:

- Social Security number or Alien Registration number

- Federal tax information or tax returns

- Records of untaxed income

- Cash, savings, checking account balances

- Investments other than your home

To complete the form online, follow these 8 steps:

- Create an account (FSA ID).You and your child should create your FSA IDs. This serves as your legal electronic signature.

- Start the FAFSA form.

- Fill out the Student Demographics section. Here’s where you’ll enter basic information about your child. Be sure you type in your child’s name and number exactly as it appears on their Social Security card.

- List the schools to which you want your FAFSA information sent. Add every school your child is considering, even if he or she hasn’t applied or been accepted yet.

- Answer the dependency status questions. These are questions to determine if your child is required to provide parent information on the FAFSA form. Even if your child supports him or herself, files taxes separately from you, or doesn’t live with you, he or she may still be considered a dependent student for federal student aid purposes.

- Fill out the Parent Demographics section.

- Supply your financial information. This step is simple if you use the IRS Data Retrieval Tool (DRT). This allows you to import your IRS tax information with just a few clicks.

- Sign your child’s FAFSA form.The quickest and easiest way to sign your child’s FAFSA form is online with your FSA ID.

Each state and school has its own deadline, so make sure you check the school’s website or call its financial aid office. You’ll find state deadlines on the FAFSA website.

Auto Loans

5 Reasons Credit Unions Offer the Best Auto Loans

The average cost of a new vehicle today is around $37,000.

Here are five reasons it makes more sense to get your loan through us.

- With us, you have a better chance of getting your loan approved. Even though the loan application process is the same and the underwriting process is similar, the credit union may make some adjustments that a commercial bank would not. Many credit unions are also more inclined to listen to its members’ needs and unique situations—sometimes adjusting terms of a loan accordingly.

- We have lower rates. A five-year term is the most common loan term for a new or used car, and rates at a credit union are typically much lower than the average rate at a competitor bank. The savings in interest alone is a major reason to consider this financing. Just think of what you can do with that money.

- We provide personalized service. Because they are non-profit organizations and work to provide members with high-quality customer service, operations decisions are made by a group of volunteer board members rather than a corporate office. You can openly discuss your concerns about your loan, talk about flexible repayment options, and review your financial situation with a professional lending officer. This can alleviate some of the pressure of applying and securing financing for your vehicle and you can be more confident that the credit union is working with your best interests in mind.

- We offer educational resources. Many credit unions will provide information such as financing options and how to make the best decisions when assessing the value of your car purchase. If you’re a first-time car buyer and apprehensive about the loan process, you can turn to a credit union for unbiased answers.

- We offer a non-sales approach. Unlike commercial banks, which often give their lenders bonuses or some type of compensation for the loans they get approved, credit unions, as not-for-profit financial institutions, work for their members and do not try to sell you something you don’t need.

The bulk of a credit union’s profits go back to members in the form of lower rates on financial products and more flexible loan options. If you don’t like the pressure of working with lenders from a commercial bank, a credit union is the answer.

Credit Cards

U.S. consumers are once again increasing their collective credit card debt, which now exceeds $1 trillion. The Credit Card Accountability, Responsibility and Disclosure (CARD) Act protections, which went into effect in February 2009, require card issuers to disclose rates and other information more clearly. This should make it easier for consumers to monitor what they owe. But, regulations can’t prevent people from making poor debt management habits.

Here’s some advice for controlling credit card use:

- Actively manage your account. Open and examine your credit card statements promptly. Look for unauthorized use, of course, but also look for announcements from the issuer. Under the new rules, you must have 45 days’ notice of a change in your card’s terms, such as an interest rate increase. If you choose to “opt out” of the change, you no longer will be able to add new charges to your card, and will want time to get a replacement while you pay off the old balance.

- Keep your credit score healthy. This number between 300 and 850 is a measure of your trustworthiness as a borrower. The higher your score, the easier it is to get a loan and, often, the more favorable the interest rate. The most important ways to maintain and improve your credit score is by paying all your bills on time and not taking on excessive debt.

- Watch your card balance-to-limit ratio. It’s OK to occasionally “max out” your credit card for important purchases, as long as you can pay it off in a few months. But over the long term, try to keep your total credit card debt to a reasonable 10% to 20% of your total credit limit. If the ratio gets much above 20%, and you can handle the payments, ask for a higher limit on your current card or get another one. Don’t add new cards too often, though, and don’t close several unneeded accounts in a short period—either move can lower your credit score.

- Understand the overlimit option. The CARD Act allows you to choose what you want your card issuer to do when you try to go over your card’s credit limit. If you “opt in,” you can go over the limit for a fee. If you “opt out,” your attempt to go over the limit will be declined.

If you don’t already have a Platinum or Classic Credit Card from Lebanon Federal Credit Union, now’s the time to get one!